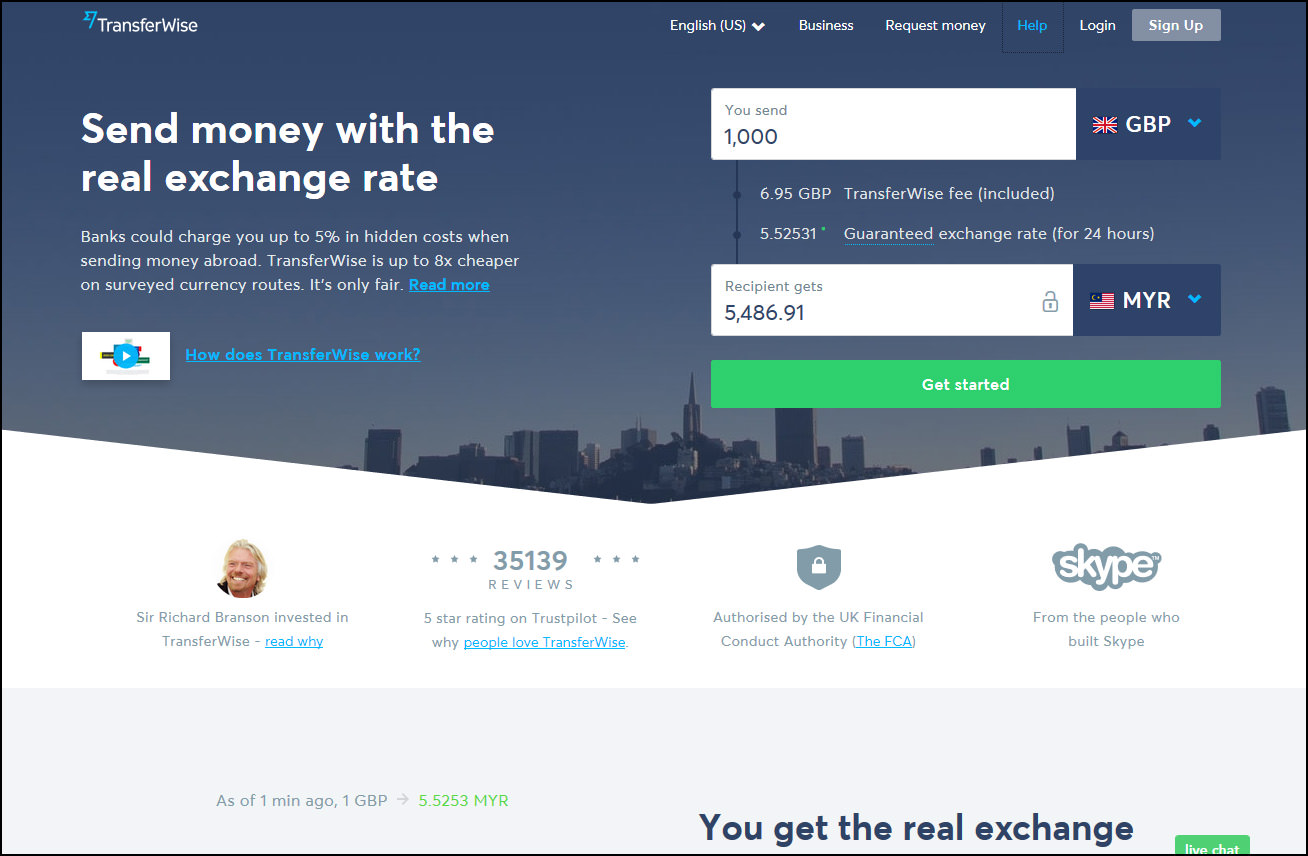

Wise provides you with a chart of the actual rate transparently. This is the fairest rate to be passed on to the consumer. The actual rate fluctuates all the time.Īlthough banks do not advertise the actual rate, it can be found on the internet. The actual market rate for currency exchanges is the average of sell-side and buy-side rates of a given currency. Receiving money through Wise is also possible even if the recipient doesn’t have a Wise account. The transfer process is notified via email or the Wise app in order to ensure transparency and security. In the event of financial difficulties or bankruptcy, the consumer funds are protected. Both entities provide institutional-level security and encryption (256-bit SSL data w/ 2048-bit key).Īdditionally, consumer account funds are kept separate from those of corporate accounts. Wise is a licensed electronic financial institution regulated by the Financial Conduct Authority (FCA) and His Majesty’s Revenue and Customs (HMRC) in the UK. Sometimes, our community members ask “ Is Wise (TransferWise) Safe to Use?” Our answer is yes. Let’s delve into some of these advantages.

#Transfer wise free

Individuals who need a multicurrency account and free withdrawals Individuals who travel frequently or make international transfers Individuals and businesses who prioritize transparent fees and exchange rates, multicurrency support Individuals and businesses who prioritize wide acceptance Limited currency support, basic customer support, limited features No cash deposits or withdrawals, limited currency support, bank transfer may take several days to clear High fees and exchange rates, limited international support Multicurrency account, physical card, free withdrawals, social and green initiatives Multicurrency account, physical card, free withdrawals Transparent fees and exchange rates, multicurrency account, physical card, free withdrawals Transparent fees and exchange rates, varies depending on the currency and plan type Transparent fees and exchange rates, varies depending on the currency Transparent fees and exchange rates, varies depending on the currency and transfer amount

Personal account: Free / Business account: 3.4% + fixed feeįree / Premium plans: 2.99 / 6.99 / 13.99 per monthįree / Premium plans: 7.99 / 10.99 / 16.99 / 19.99 per month Wise offers dedicated customer support to its customers, with support available in multiple languages and through multiple channels, including email, phone, and chat. Wise is regulated by the Financial Conduct Authority in the UK and licensed in several other jurisdictions, ensuring that customers’ money is safe and protected. Wise is a trusted name in the industry, with over 10 million customers worldwide and a proven track record of offering reliable and secure services. Wise offers customers fast transfers, with most transfers taking just a few hours to complete. Wise has integrated with popular money apps such as Venmo and Google Pay, allowing customers to easily send and receive money across borders. Wise allows customers to transfer money in over 70 currencies, making it an ideal platform for businesses and individuals who need to transfer money internationally. Wise offers a debit card that is linked to its borderless account, allowing customers to withdraw money from ATMs and spend money in different currencies without incurring any hidden fees or unfavorable exchange rates. With a Wise borderless account, customers can hold and manage money in up to 50 currencies, allowing them to easily send, receive, and spend money in different currencies. Wise offers its customers the mid-market exchange rate, which is the real exchange rate at which currencies trade in the global marketplace, without any hidden fees or markups. Wise offers its customers some of the lowest fees in the industry, making it an affordable option for those looking to transfer money internationally.

0 kommentar(er)

0 kommentar(er)